Bitcoin

What the heck is it?

Electronic Cash

Bitcoin is money for the internet. Bitcoin can be sent just like an email. The Euro has 2 decimal places, and €0.01 is called a cent. Bitcoin has 8 decimal places, and B0.00000001 is called a satoshi.

Satoshi Nakamoto

Satoshi Nakamoto is the pseudonym of the person (or persons) who created Bitcoin. The real identity of Satoshi Nakamoto is unknown. Satoshi is a masculine Japanese name meaning wise. A profile created by Satoshi on the forum p2pfoundation in 2008 indicated a 35-year-old male located in Japan. There is much deliberation over the identity and motives of Satoshi Nakamoto.

Double Spend

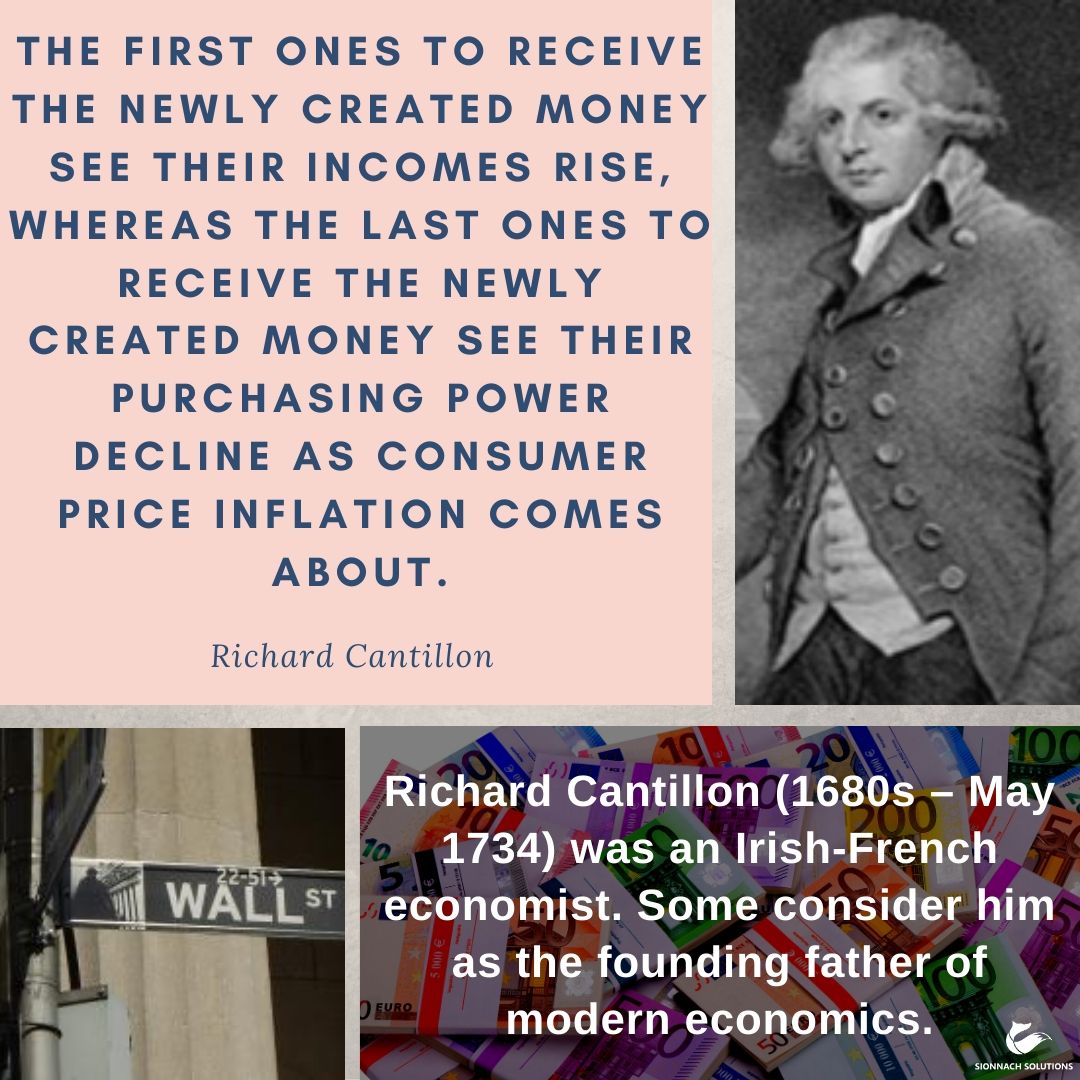

It was in the autumn of 2008 that Satoshi Nakamoto published his infamous white paper Bitcoin: A Peer-to-Peer Electronic Cash System. In it was an ingenious solution to a problem that had puzzled cryptographers for the previous two decades, the double spend. The double-spend is to spend the same money a 2nd time.

Trusted Third Party

Before Bitcoin, to send money over the internet, a trusted third party such as PayPal, MasterCard or Bank of Ireland, was needed. The trusted third party ensures that the sender has sufficient funds. They may also mediate disputes and issue chargebacks.

Distributed Ledger

Bitcoin turns on its head the security model that is the foundation of existing monetary systems. It eliminates the need for a trusted third party. Instead of a private, centrally controlled accounting ledger, Bitcoin proposes a widely distributed public ledger called a blockchain.

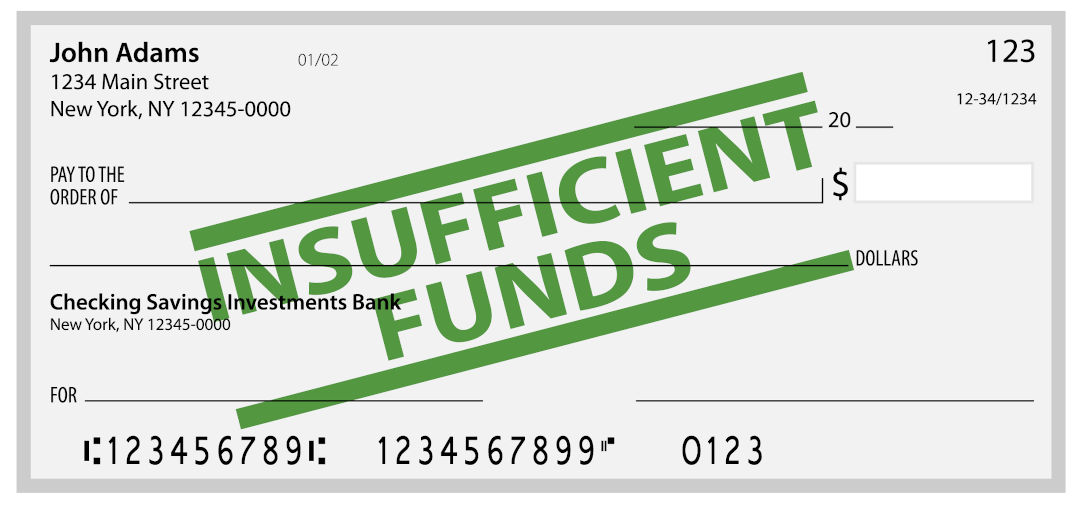

Cryptography

Electronic money (eMoney) was a hot topic in cryptography circles since the dawn of the modern internet in the late 1980s and early 1990s. Cryptography keeps communication safe by obscuring data while it travels from the sender to the recipient. It would be crucial in any eMoney system, and this is why Bitcoin is known as a cryptocurrency.

eMoney

There were attempts to create eMoney before Bitcoin. There was Ecash in the early 1990s. Then there was Bit gold, RPOW and b-money. They all had issues, and eventually, they all failed. According to Satoshi, attempts to create eMoney had failed because they were all centrally controlled.

Mining

In January 2009 Satoshi released free open source software, Bitcoin Core, for creating and maintaining the Bitcoin blockchain. The software runs a process known as mining. The mining process is a challenge between users of the software, who are known as miners. The aim is to be the first to solve a problem that is very difficult (but it’s easy to verify the solution).

Proof-Of-Work

The mining process is more formally known as a proof-of-work system. Proof-of-work is an anti-spam technique. It's something like Google Captcha's, where you must select some particular images (do some work) before you can access a website.

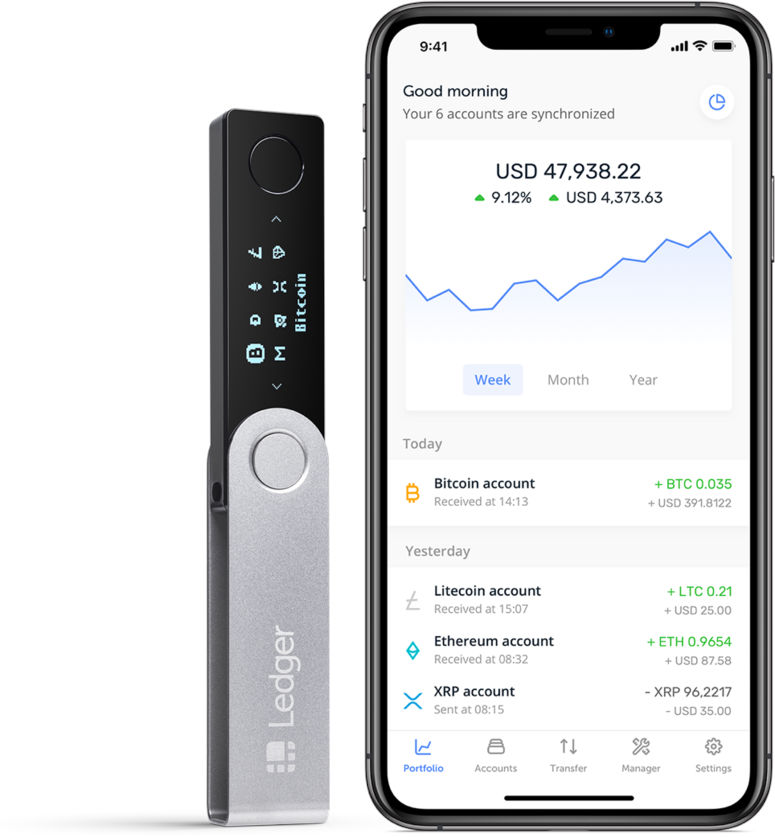

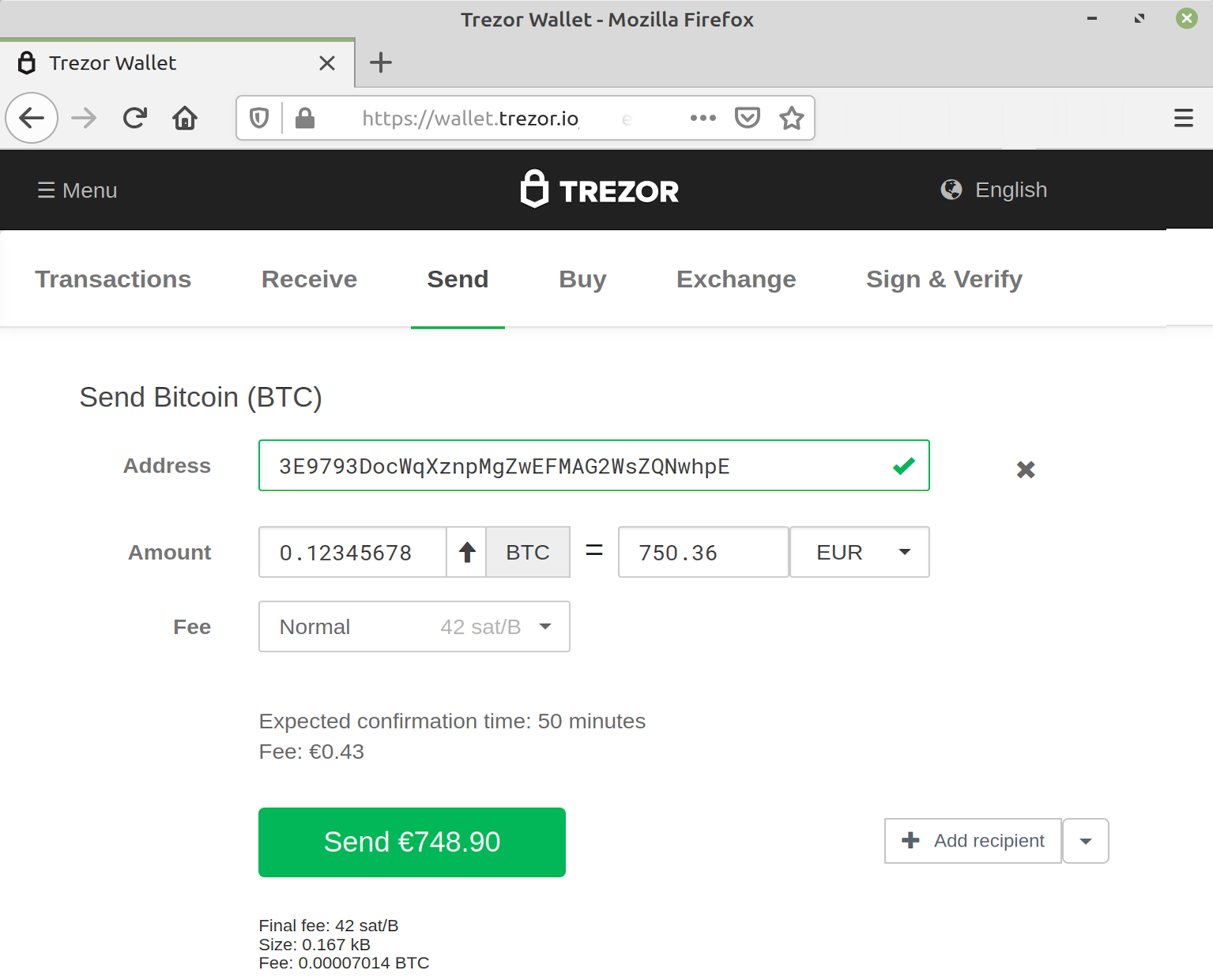

Wallet

In February 2009 Satoshi released the first Bitcoin wallet software to allow the sending and storing of Bitcoin. There are numerous hardware and software wallets available today. Hardware wallets claim increased security, but nothing is entirely secure.

Address

A Bitcoin address is needed to receive and store Bitcoin. A Bitcoin wallet allows you to create multiple addresses, somewhat akin to having multiple bank accounts.

Pseudonymity

A Bitcoin address gives you pseudonymity. When Bitcoin is received, the address of the recipient and the amount of Bitcoin received is forever recorded and available for viewing on the public blockchain. It is said to be more secure and private to use a new address for each transaction.

Trust

Before the 1970s, if two parties wanted to share encrypted data, both parties needed access to the same password to either encrypt or decrypt the data. This password, technically known as a secret symmetric key, would have to be shared in a secure way such as by courier or registered mail. This process did not facilitate efficient business telecommunication. When Whitfield Diffie and Martin Hellman published their paper New Directions in Cryptography in 1976, things changed.

Public-Private Keys

Instead of a single secret symmetric key, Diffie & Hellman proposed two asymmetric keys. One private key which the owner keeps secret, and one public key, which can be widely shared. The public key encrypts data which only the corresponding private key can decrypt.

Digital Signatures

The private key creates tamper-proof, digitally-signed, non-encrypted messages. The public key verifies that the signed message is precisely what the sender wrote.

Transaction

A Bitcoin address is essentially the public key of a public-private key pair. The private key digitally signs a Bitcoin transaction. The public key verifies the transaction. Transactions broadcast to the Bitcoin network wait with other unconfirmed transactions.

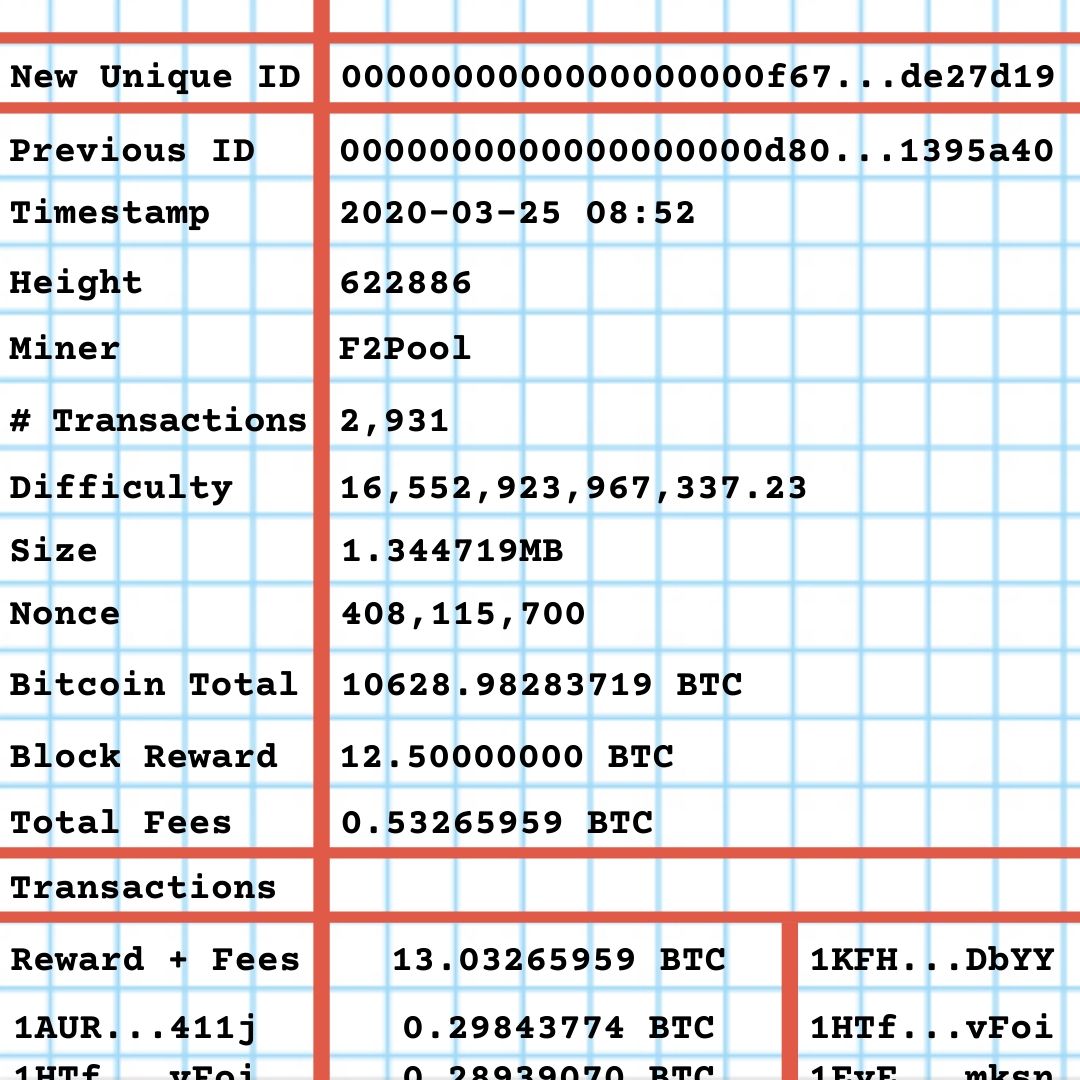

Block

Bitcoin miners pick transactions from the unconfirmed group so that they may become confirmed. Transactions are added to a structure known as a block, essentially an accounting ledger. A block is limited in size at about 1-megabyte, which accommodates about 3,500 transactions.

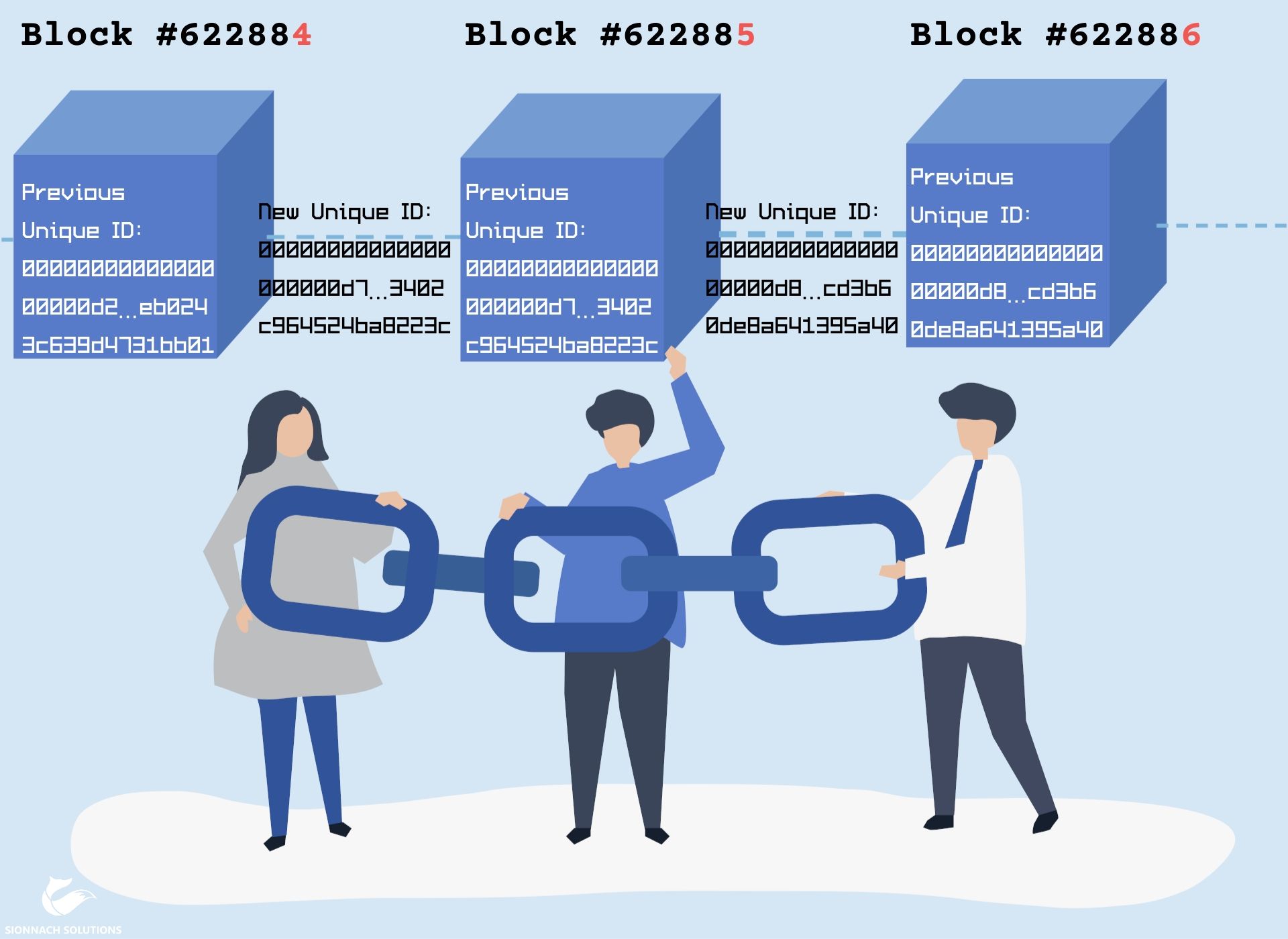

Blockchain

Each Bitcoin miner creates a new block each time the previous problem is solved. Once a miner solves the problem, they broadcast their solution along with their block. If accepted as a valid solution, the block links to the previous block, creating a sequence of chained blocks, i.e. a blockchain.

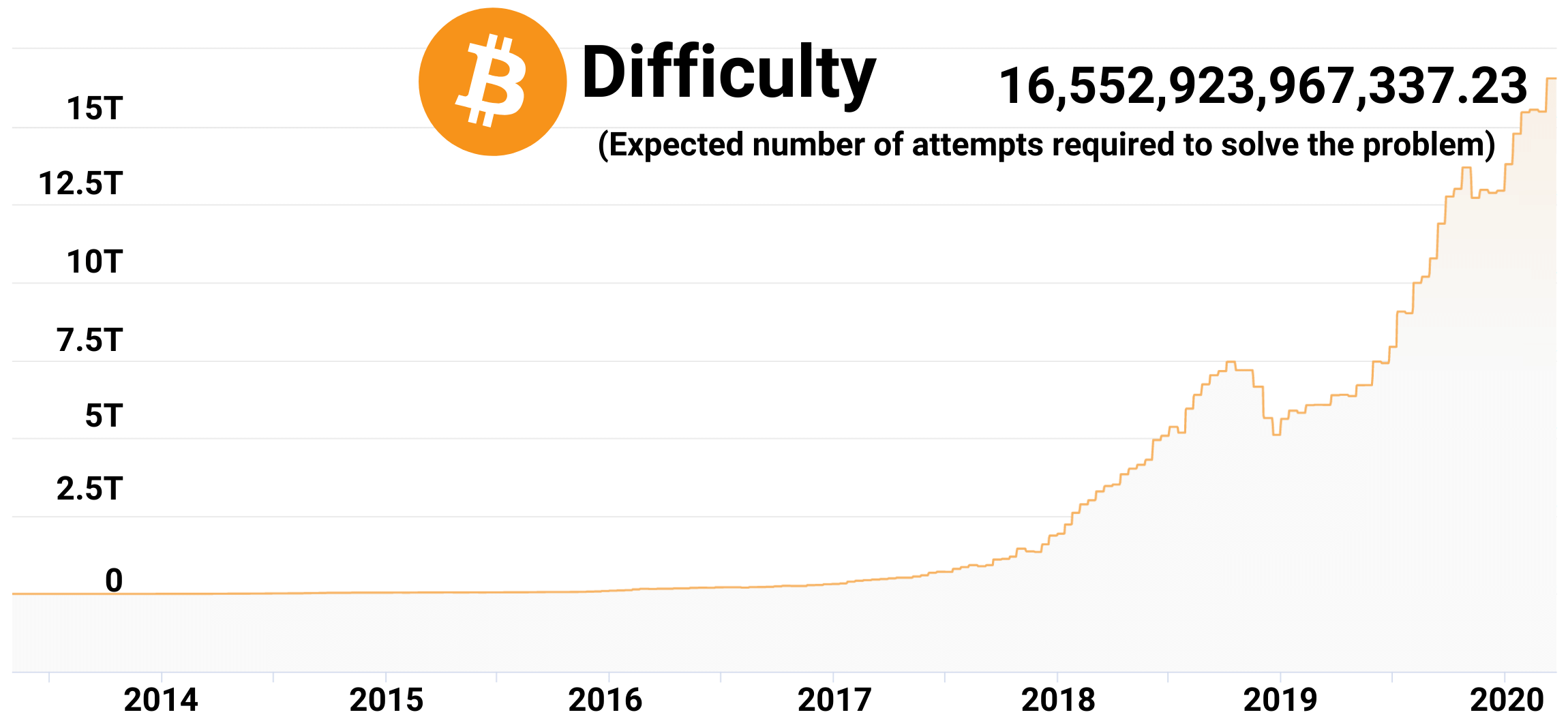

Difficulty

The Bitcoin system adjusts the difficulty of the problem roughly every two weeks. The aim is to keep an average time to solve the problem at 10 minutes. The results in a block of transactions being added to, or confirmed on, the blockchain every 10 minutes.

Source: coinwarz.com

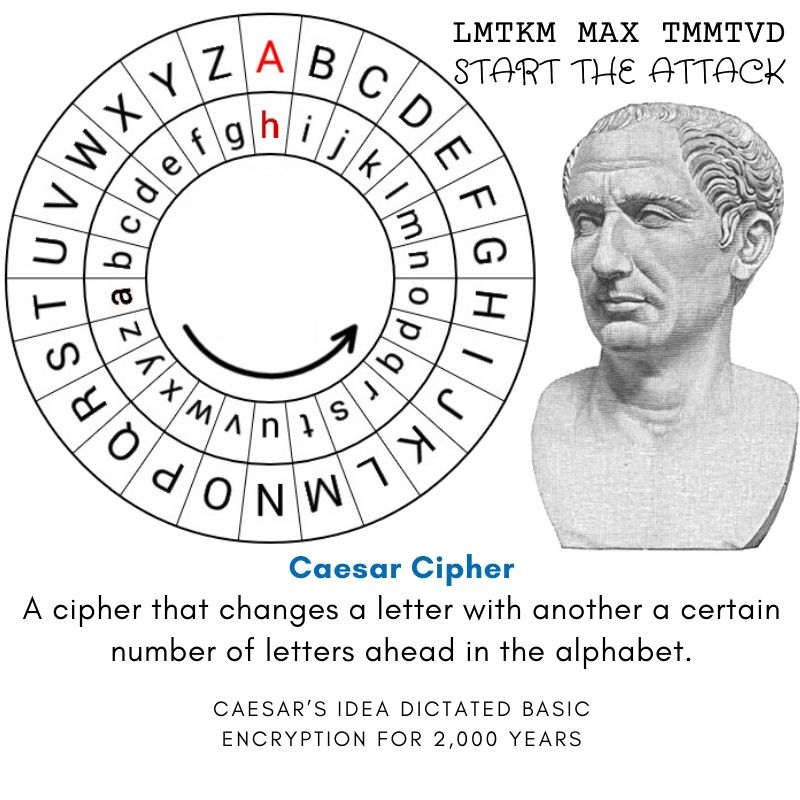

Minting

The solving of the problem triggers the awarding of new Bitcoins to the successful miner. All Bitcoins are created and distributed in this way. Mining is akin to the European Central Bank printing and issuing new Euros.

Source: mises.org

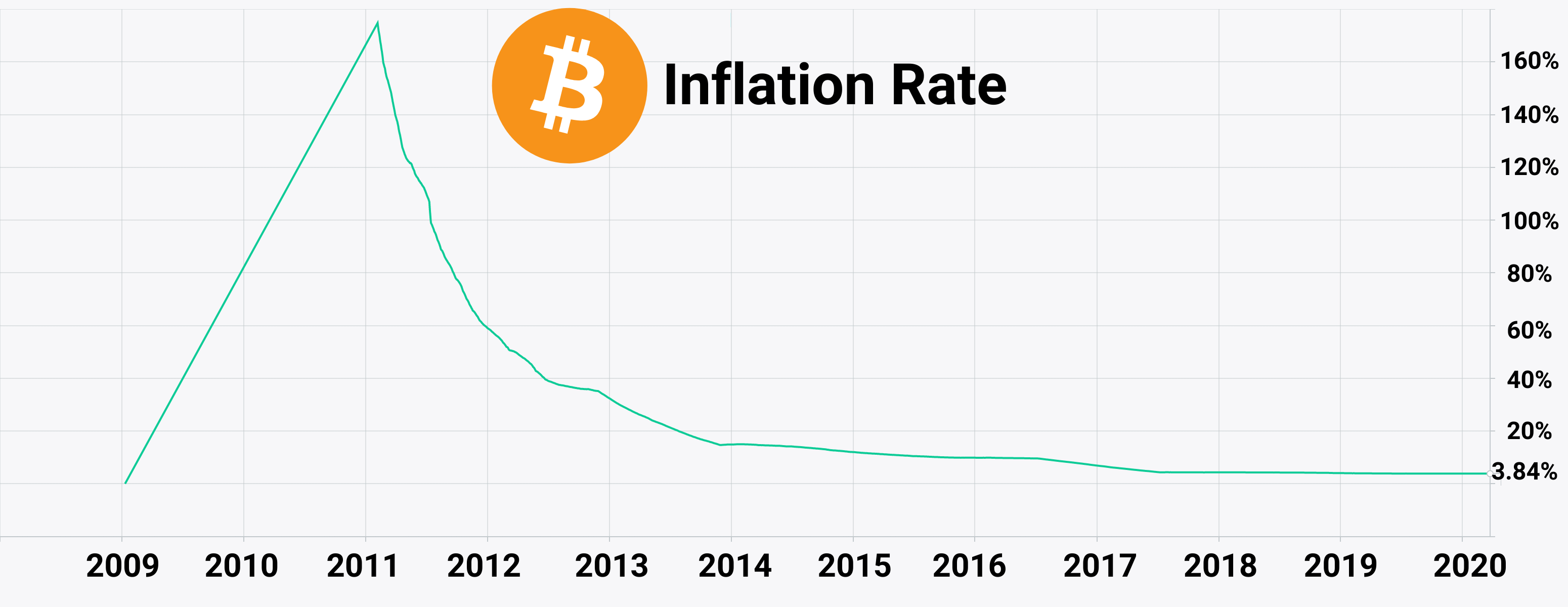

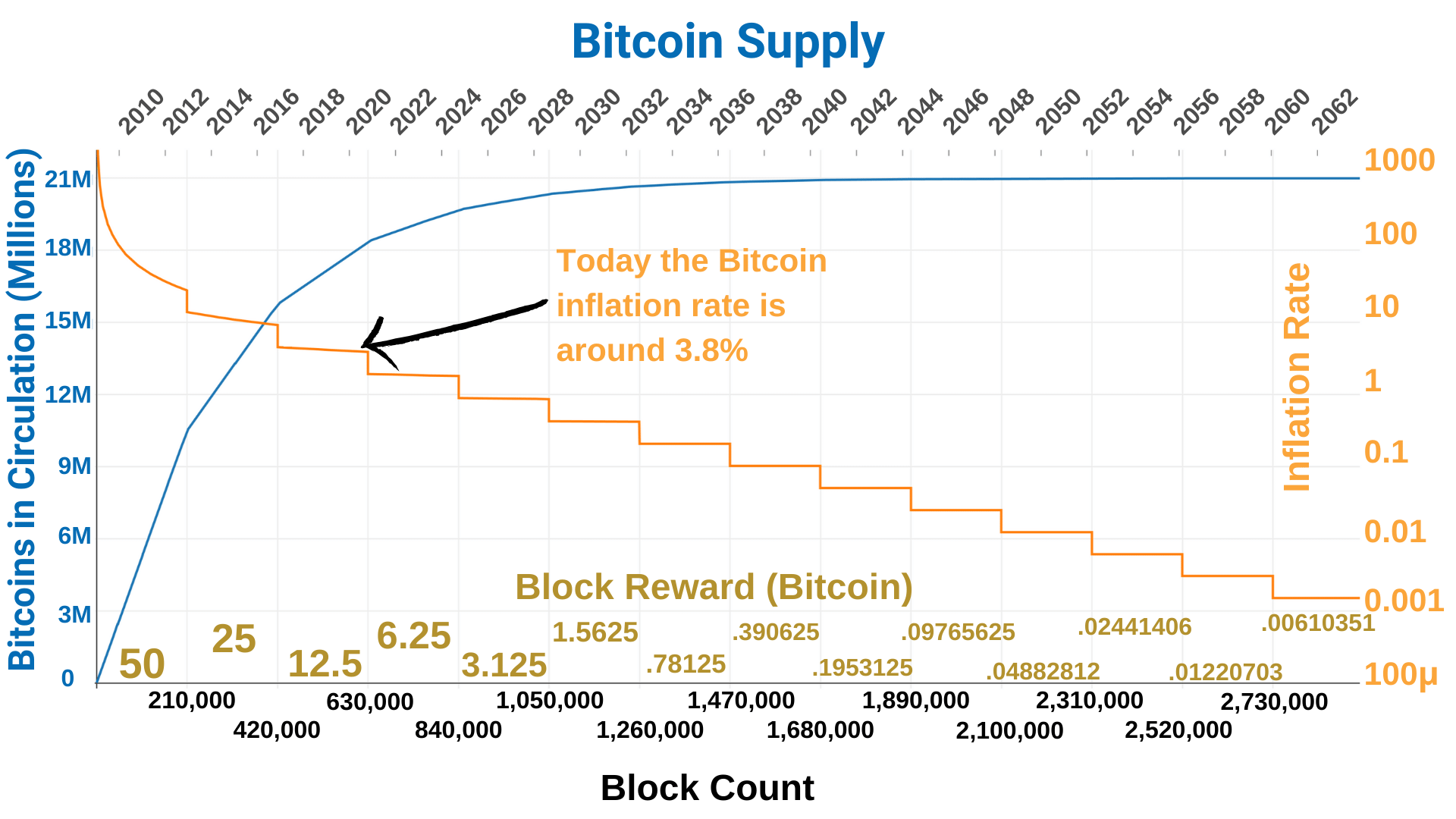

Halving

It is set in the Bitcoin system to halve the amount of Bitcoin awarded for adding a new block to the chain every 210,000 blocks. When Bitcoin started in 2009, the reward for adding a block to the chain was 50 Bitcoins. The first halving, down to 25, occurred on the 28th of November 2012. The second halving, down to 12.5, occurred on the 9th of July 2016. The third halving, down to 6.25 Bitcoins, is expected to occur in May 2020.

Source: charts.bitcoin.com

Limit

There is a preset limit of 21 million Bitcoins coded into the Bitcoin software. This limit is due to be reached in the year 2140. At this point, no more new Bitcoins are created and awarded for adding a new block to the chain.

Source: cointelegraph.com

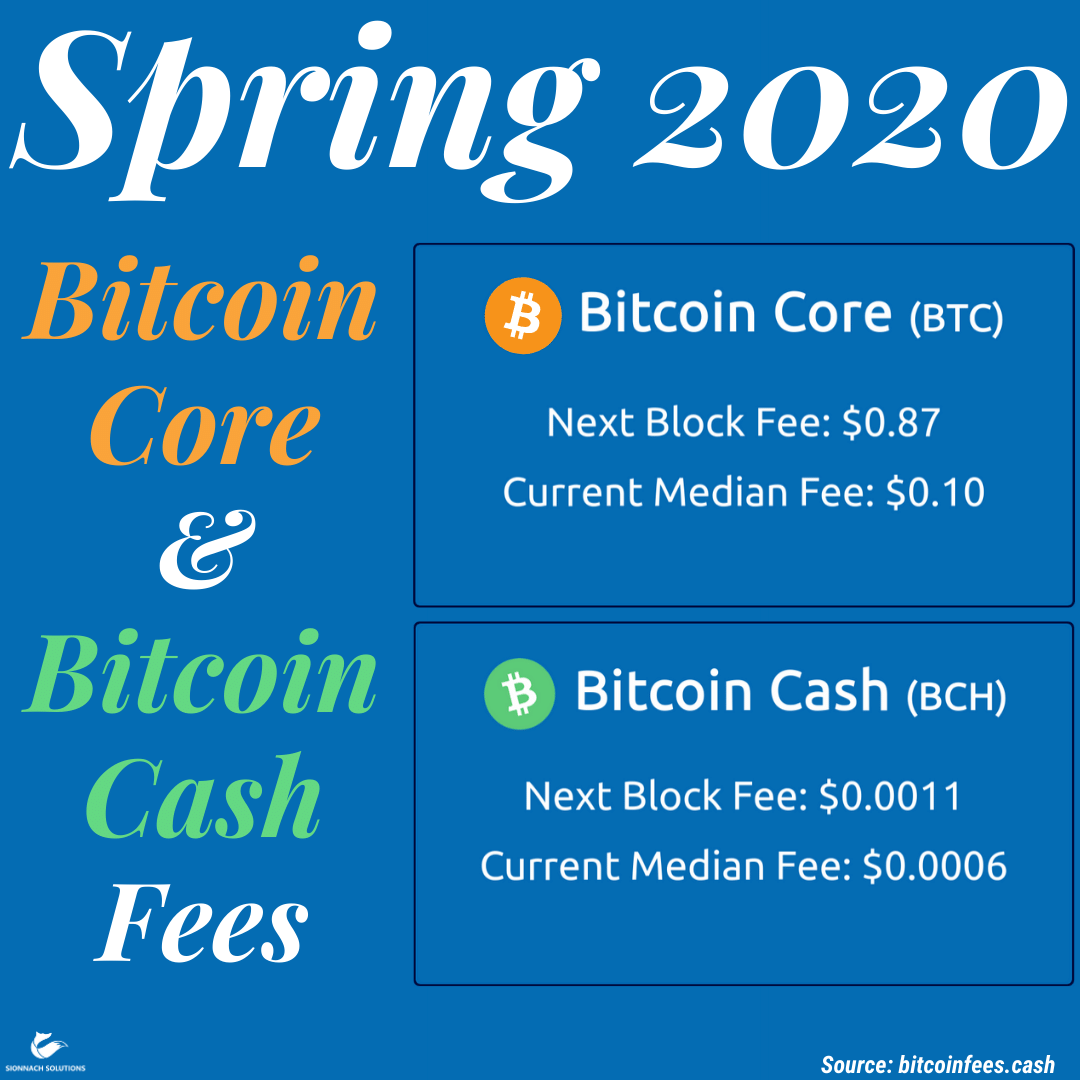

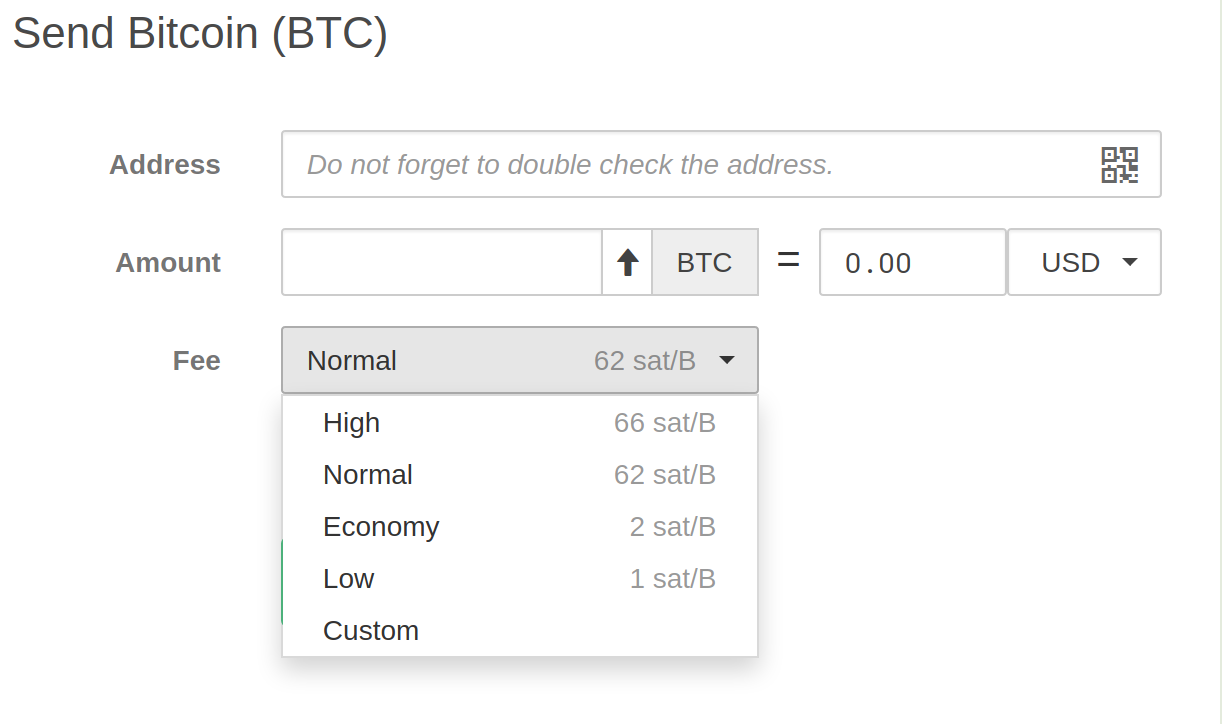

Fees

Fees can, and typically should be added in each Bitcoin transaction. Wallet apps add the appropriate fee to the transaction automatically. The required fee can vary dramatically. However, the average transaction fee is generally less than €1. The fees are added to the reward for mining a block. When Bitcoin reaches its limit in the year 2140, these fees are the only reward for mining a block.

Reference: bitcoinfees.earn.com

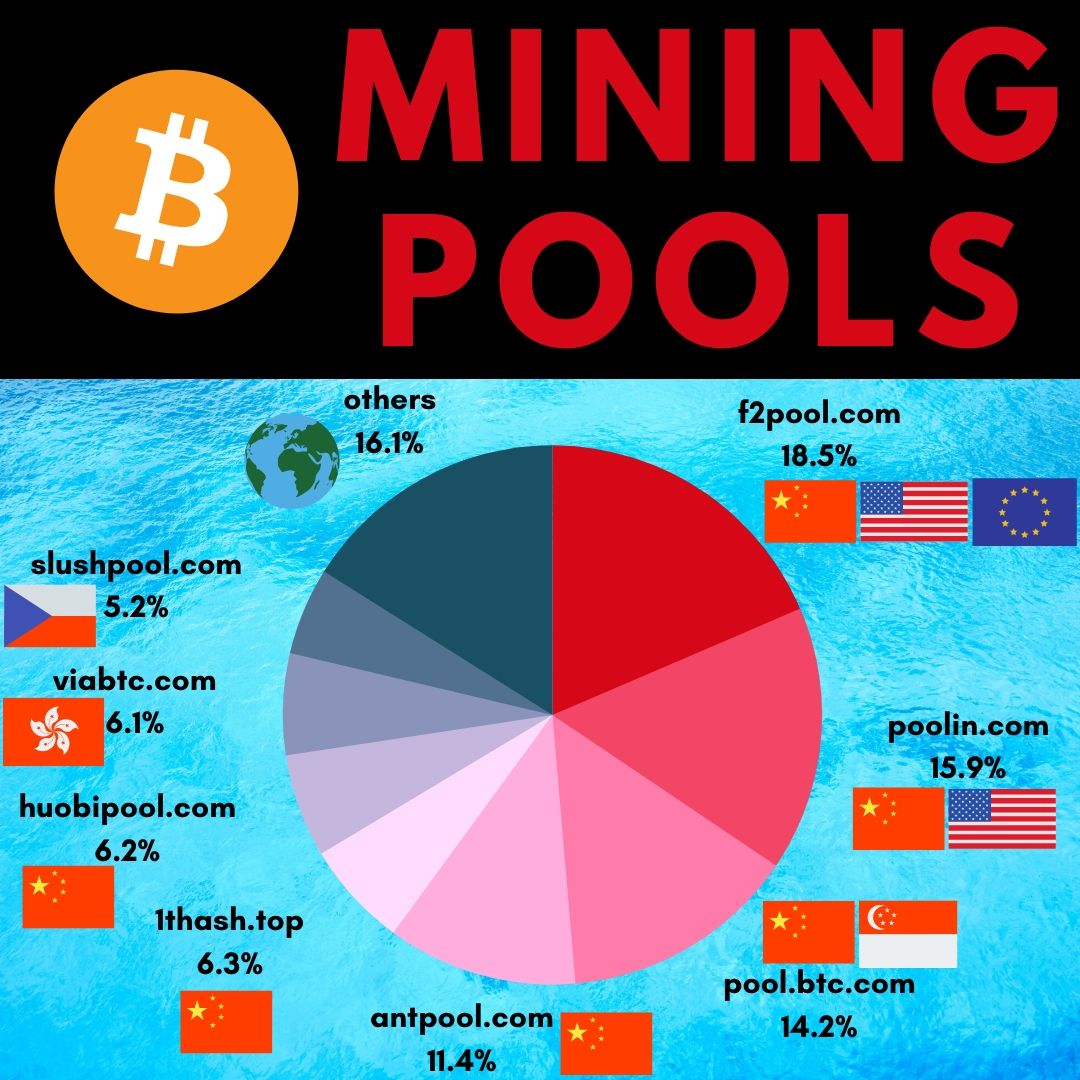

Mining Pools

When the Bitcoin blockchain started in January 2009, there were not many miners mining Bitcoin. A typical home pc could have run the Bitcoin Core software and have a reasonable chance of mining a block. However, before the end of 2010, miners were grumbling about mining for weeks without reward.

Thus begins the creation of mining pools where miners combine their computing power. The larger group has more chance of mining a block. Any Bitcoin awarded is split amongst the group, relative to the computing power they provided. The owners of the mining pool take a fee of about 5% from each reward.

Equipment

The computing hardware used to mine Bitcoin is continuously evolving as miners seek to gain an edge on each other. In a forum post made in December 2009, Satoshi asked for there to be a "gentleman's agreement to postpone the GPU arms race as long as we can for the good of the network".

ArtForz may have been the first to break this agreement with his Graphics Processing Unit (GPU) mining setup in 2010. By 2013, academia were discussing the creation of bespoke hardware, known as Application-Specific Integrated Circuit (ASIC), for mining Bitcoin. A popular ASIC such as the Ant Miner S9 costs about €100.

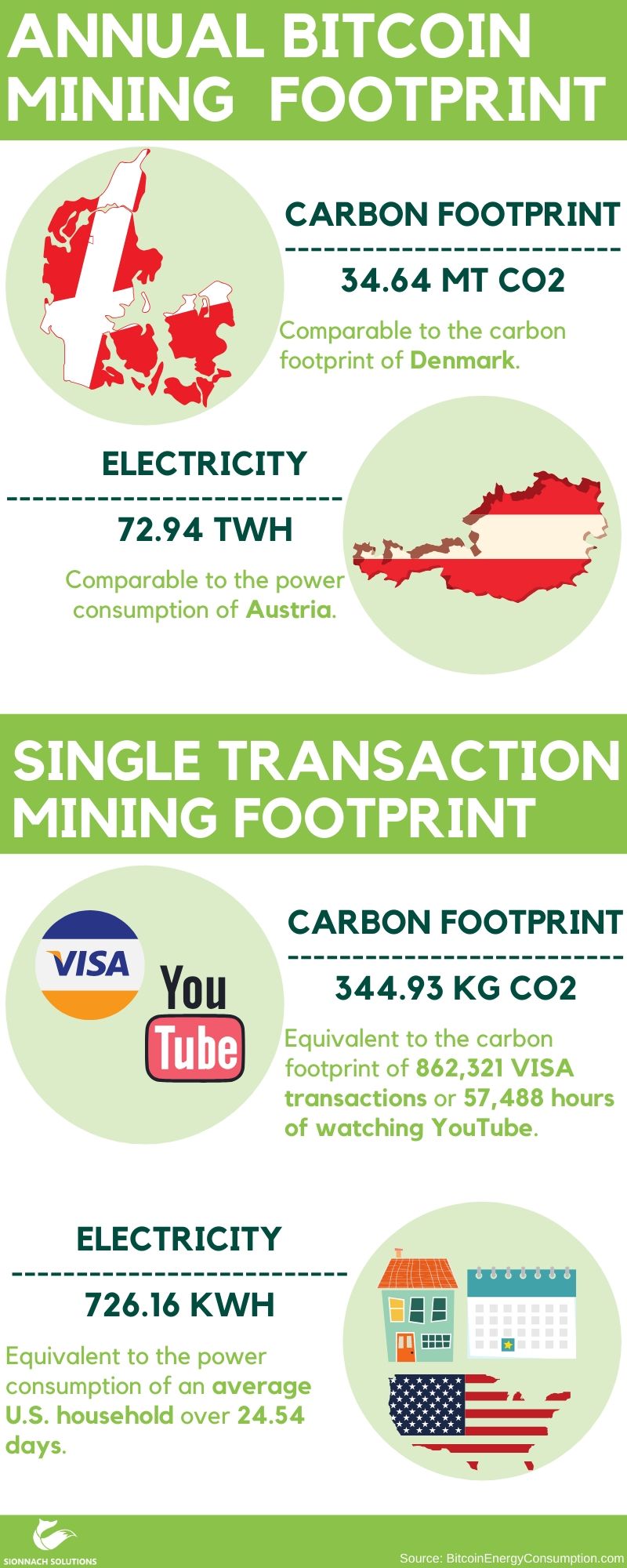

Electricity

After the cost of the equipment, it is the cost of electricity that determines if Bitcoin mining is profitable. At a rate of €0.15 per kiloWatt/hour (kWh), and a market value of €7,500 per Bitcoin, 100 Ant Miner S9’s could mine circa €50,000 worth of Bitcoin, but would have run up an electric bill of €150,000.

Jurisdictions like Quebec, with residential rates as low as €0.05 per kWh and industrial rates as low as €0.01 per kWh, are particularly appealing to Bitcoin miners. Quebec's Energy Board has a love/hate relationship with Bitcoin miners. Over the past decade, they have welcomed, rejected and most recently conditionally allowed Bitcoin miners access to their energy surplus.

Source: BitcoinEnergyConsumption.com (digiconomist.net)

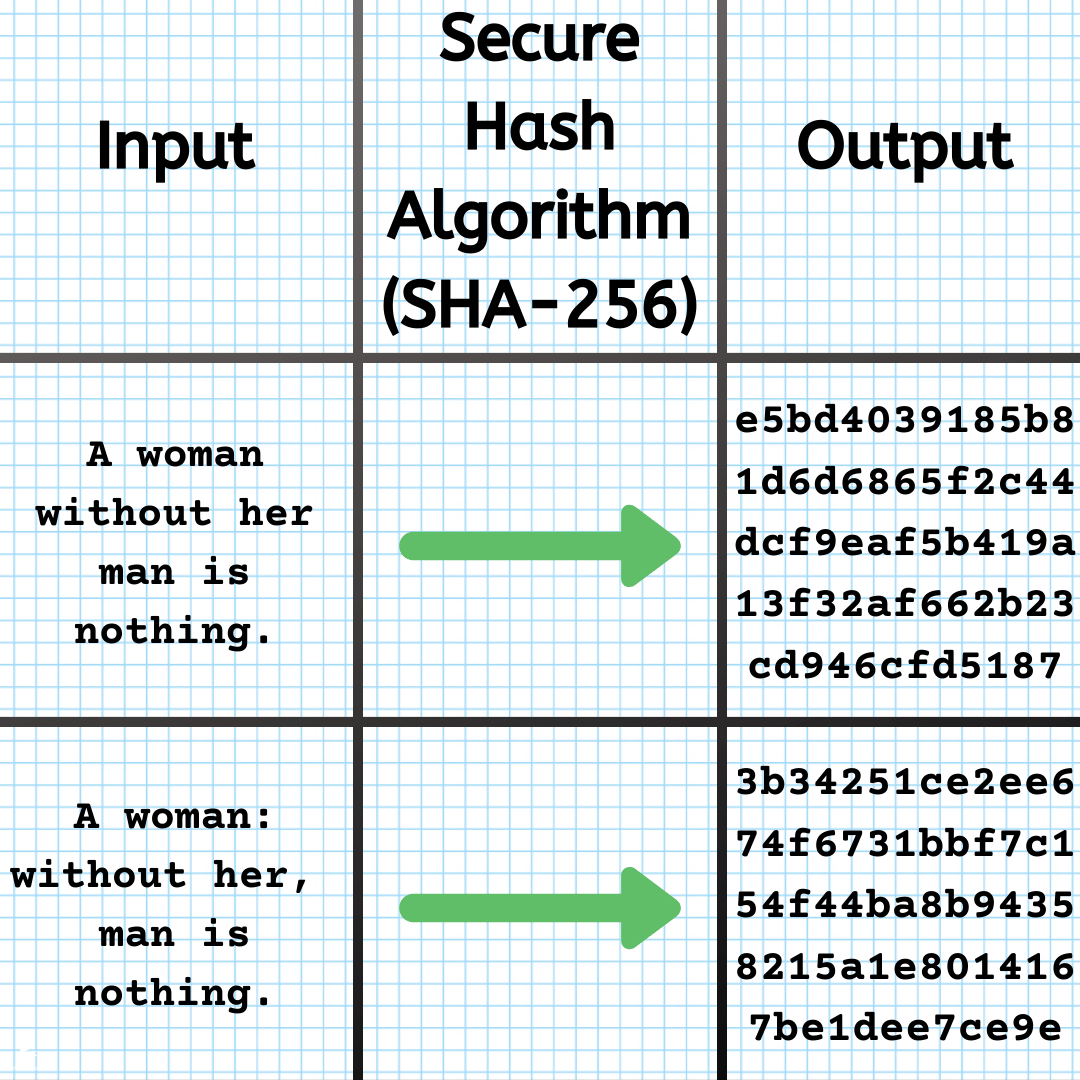

Hashing

Bitcoin uses hashing to maintain the integrity of its blockchain. Hashing is a computer algorithm that can generate unique and fixed-length output, known as a hash value, from any amount of input. There are many types of hashing algorithms. The one used by Bitcoin is called SHA-256. It produces output that is 64 characters in length, and you can try it here.

Integrity

Hashing is a superb tool for verifying the integrity of data. The outputted hash value is the unique signature of the inputted data. If even a single character of the input is changed, the outputted hash value is entirely different.

Problem

The Bitcoin mining process is running the SHA256 hashing algorithm repeatedly. The problem that the Bitcoin Core software creates for the miners is to be the first to create an output hash value that starts with a certain amount of zeros. The input data for the hash algorithm is the entire Bitcoin blockchain, plus a new block of transactions.

Nonce

To produce different output for each hash, a number, known as a nonce, is added to each block. The number can range from 0 to 4,294,967,295. There are various techniques for attempting to solve the problem. Still, essentially it's just a brute force attempt trying one nonce value at a time. Miners have other ways, such as picking different transactions, for adjusting their input block.

Source: merriam-webster.com

Longest Chain

When a miner adds a new block to the blockchain, it broadcasts its new, more extended version of the blockchain, over the Bitcoin network. Coded into the rules of Bitcoin is that miners must accept the longest chain as the one true copy of the Bitcoin blockchain.

Immutable

The Bitcoin blockchain is said to be immutable, meaning that it's a permanent, un-editable transaction store. Transactions that are in the most recently added blocks are susceptible to being reversed in what's known as a 51% attack. Even with a 51% attack, transactions become theoretically impossible to reverse as soon as 3 or 4 more blocks are chained.

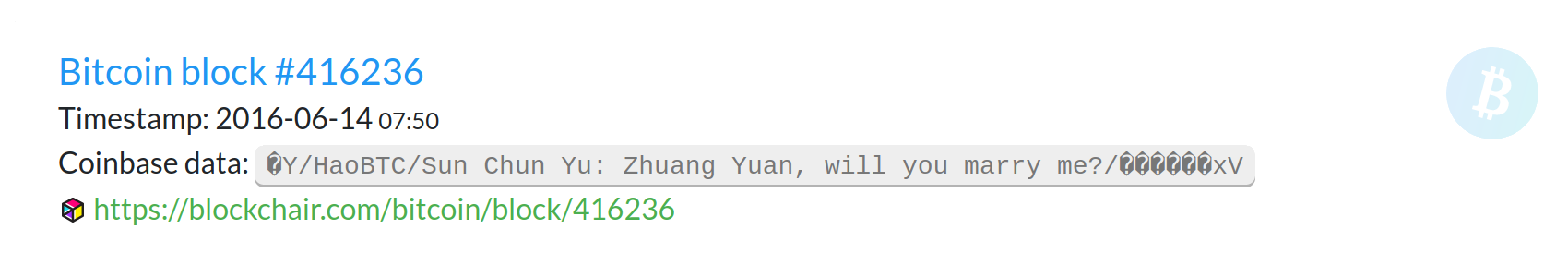

Source: blockchair.com

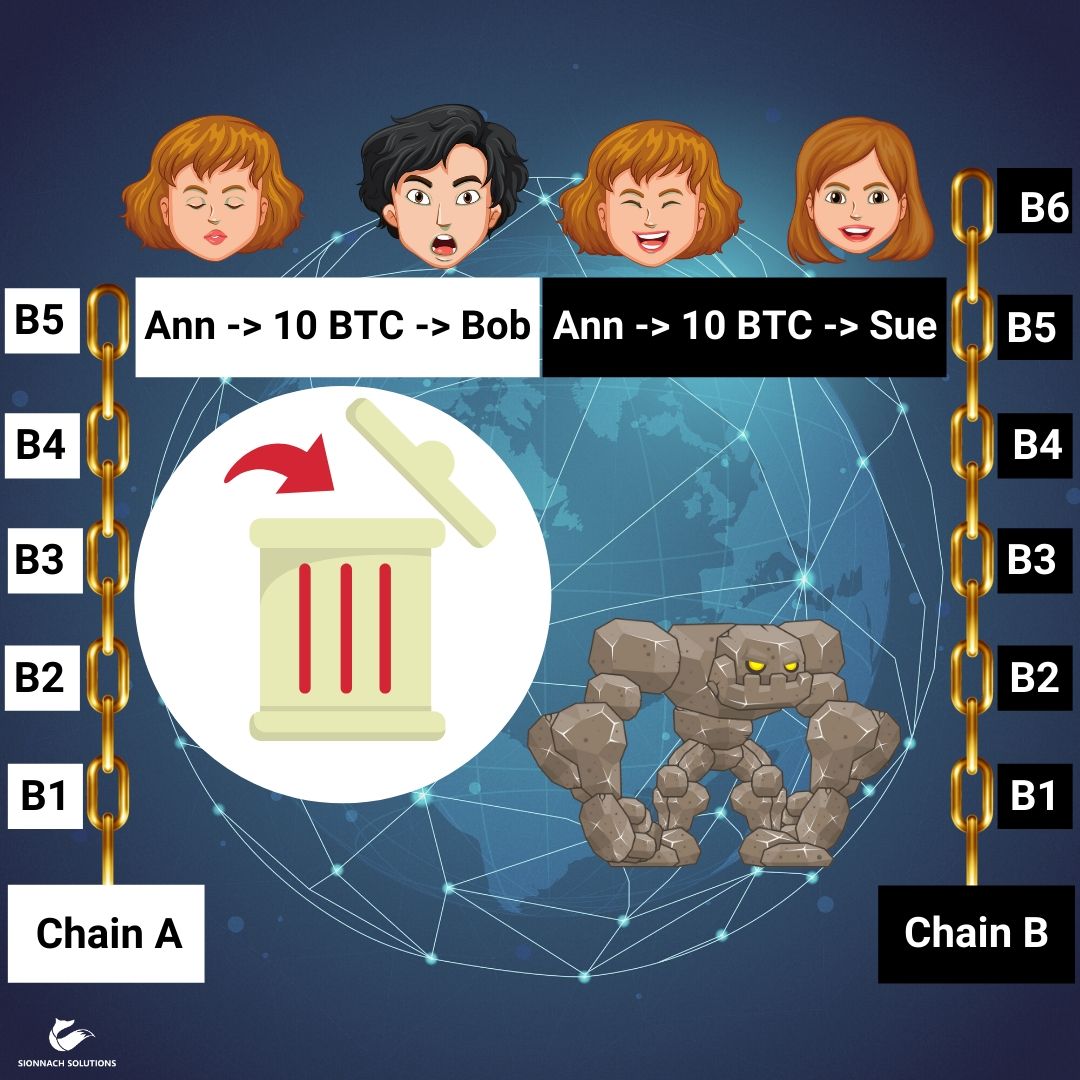

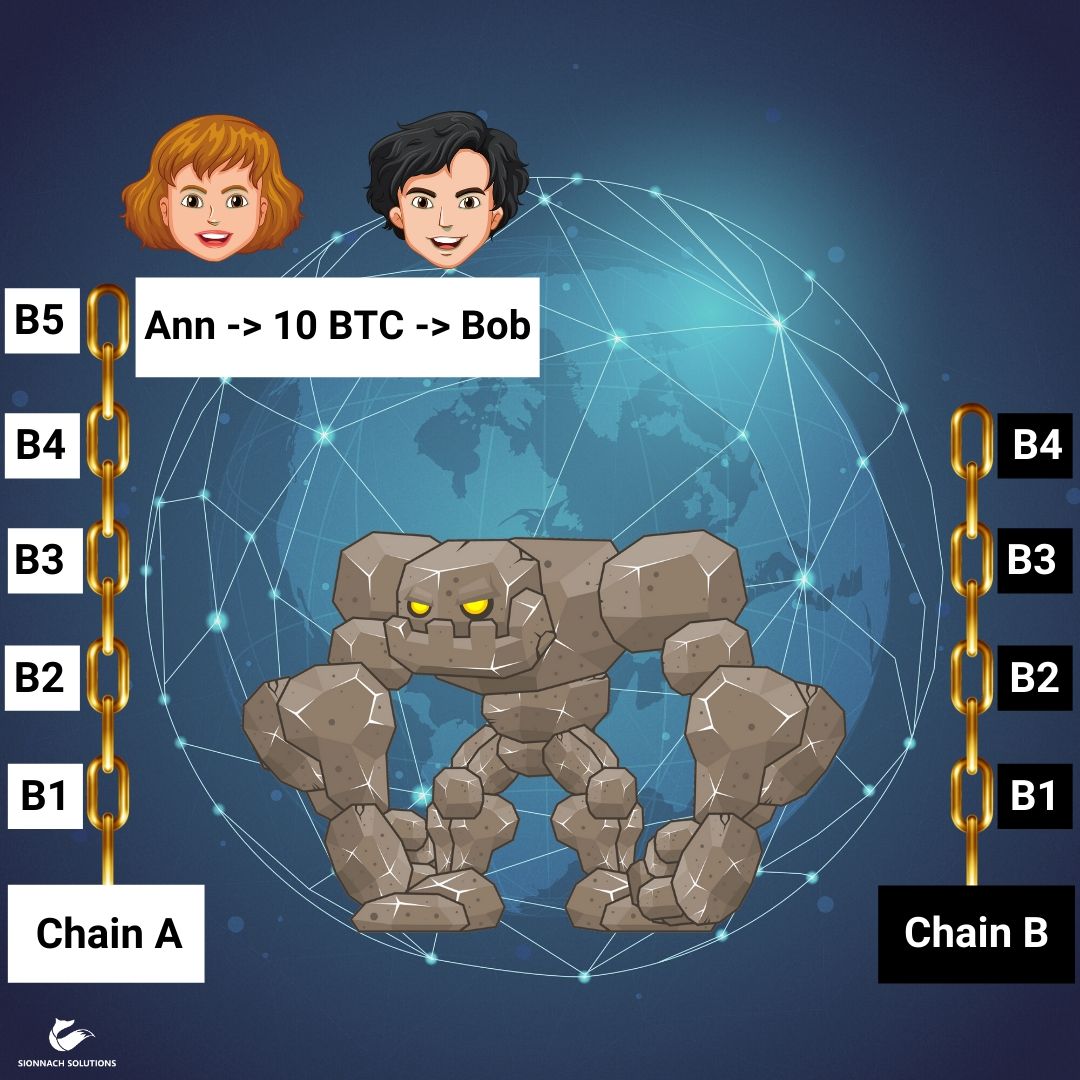

51% Attack

The Bitcoin blockchain is reliant on the majority of miners being honest. If a mining pool gained more than 50% of the total hashing power, they could take control of the blockchain for several blocks in a row. A rogue miner could work on two versions of the blockchain at once.

In version A, they could have a particular transaction and broadcast it to the network. If the receiver is hasty, they may see that they have received the Bitcoins at their address in the most recent block on the chain. The rogue miner could then push another version B, without that particular transaction. The rogue miner needs to add another block to version B before another miner can add one to version A (containing the transaction they want reversing).

However, it would soon become apparent, after just 1 or 2 blocks, that a group of miners are rogue. The rest of the network could just ignore them, and their efforts may not have been worth the considerable effort and cost involved.

Full Node

Bitcoin offers software, known as full node, that validates transactions and blocks. Its purpose is to allow anyone to be able to verify for themselves the Bitcoin blockchain. It supports the integrity of the network and assists in the relaying of transactions and blocks to others on the Bitcoin network.

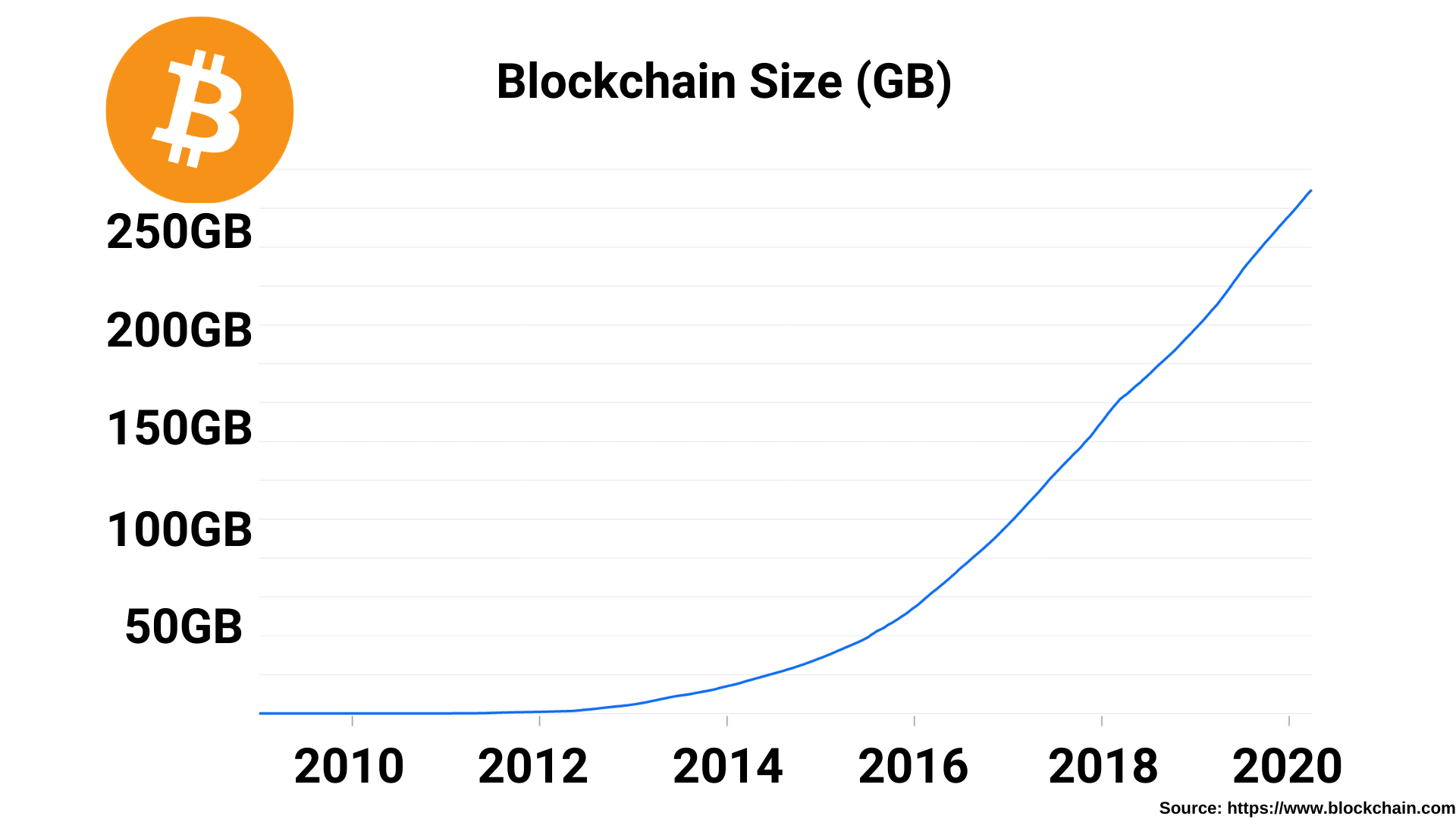

It takes a reasonable amount of network bandwidth to run the software. It downloads the full Bitcoin blockchain at first, which is currently over 250GB. According to bitcoin.org, you can expect to upload 200GB and download 20GB each month. Running this software is known as running a full node.

Source: blockchain.com

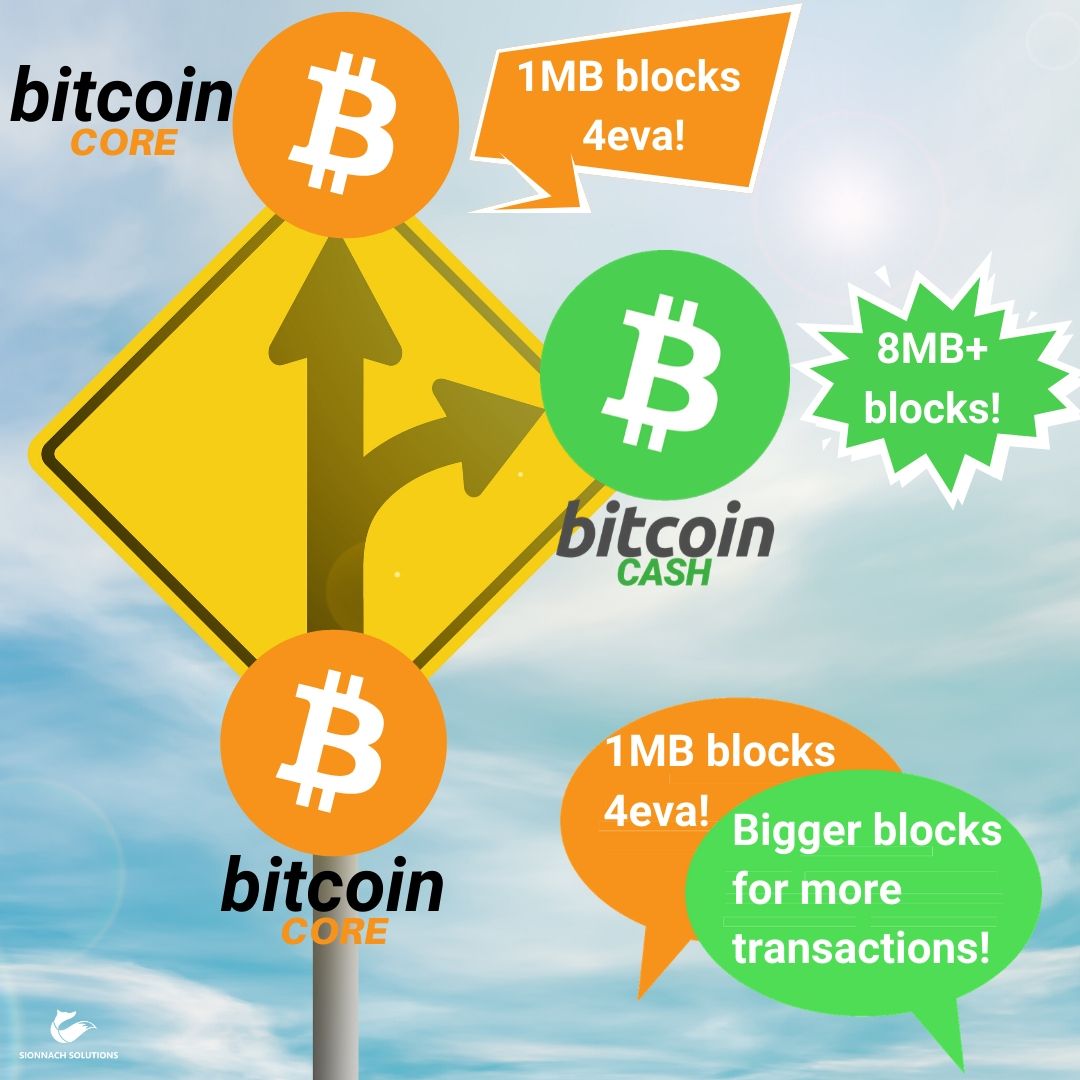

Block Size

There is much debate over Bitcoins 1MB block size. Given the average block time of 10 minutes and a maximum of circa 3,500 transactions, the Bitcoin network can process circa 10 transactions per second. Paypal processed 450 payments per second on Cyber Monday in 2015. Visa state that they average 1,667 transactions per second and are capable of handling 56,000 transactions per second.

Some in the Bitcoin community want larger blocks for higher transactions per second so that Bitcoin can be a daily use currency like euros. Others want the block size to remain as is as they prefer to see Bitcoin as a store of value like gold.

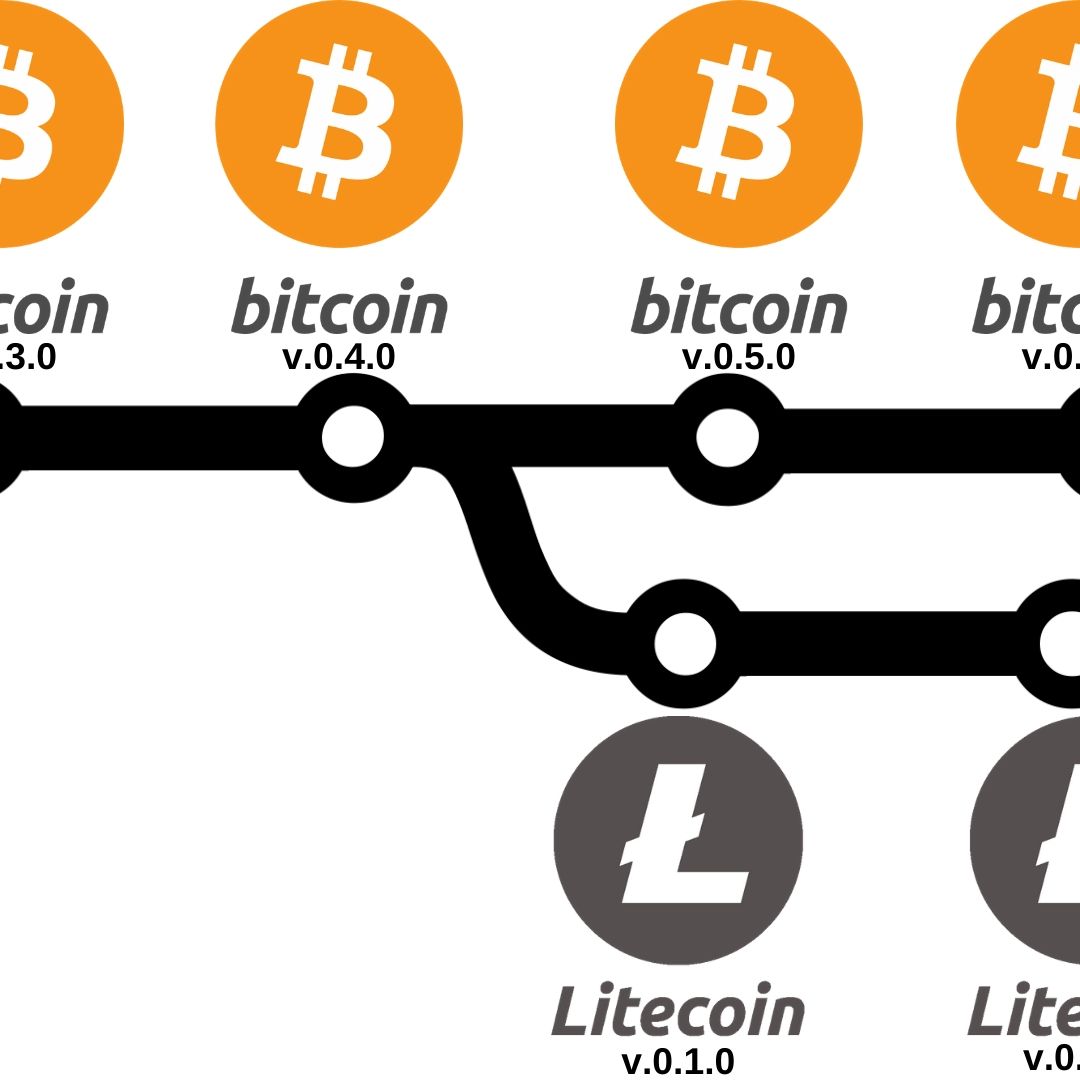

Forking

Software releases occur in versions with new features added or broken features fixed in each new version. Since Bitcoin is open-source software, the code from each version of its release is available to the public. Permission is granted to take any version as a basis for another cryptocurrency or blockchain application in a process known as (software) forking.

Litecoin started as a fork of the Bitcoin code in 2011. Litecoin reduced the block time down to 2.5 minutes compared to 10 minutes for Bitcoin. Litecoin has a max supply of 84 million coins compared to 21 million for Bitcoin. Litecoin uses a different hashing algorithm, scrypt, compared to SHA256 used by Bitcoin.

Splits

In 2017, in an attempt to resolve the Bitcoin block size debate, a fork was made of the Bitcoin software that increased the block size from 1MB to 8MB. A split occurred in the mining community. Most ignored the forked version and continued to use the version of Bitcoin with 1MB blocks. However, some miners did use the 8MB version of the software, thus creating another version of Bitcoin that would be known as Bitcoin Cash. In 2018, due to further disputes within the Bitcoin Cash mining community, a fork of Bitcoin Cash was created that would be known as Bitcoin SV (Satoshi Vision).

Air Drops

These forks give a bonus, known as an airdrop, to holders of the coin that forked. If you had a certain number of Bitcoin when Bitcoin Cash was forked, you would have the same number of Bitcoin Cash. The same as when Bitcoin SV forked from Bitcoin Cash, you would have the same number of coins on the new Bitcoin SV blockchain.

Exchange

A cryptocurrency exchange is a platform to convert between euros and cryptocurrencies, or between cryptocurrencies. Exchanges are many peoples route into cryptocurrencies, but there are security concerns. There are hacks, scams and bankruptcies aplenty to be found in the decade long history of cryptocurrency exchanges.

Binance is becoming more compliant

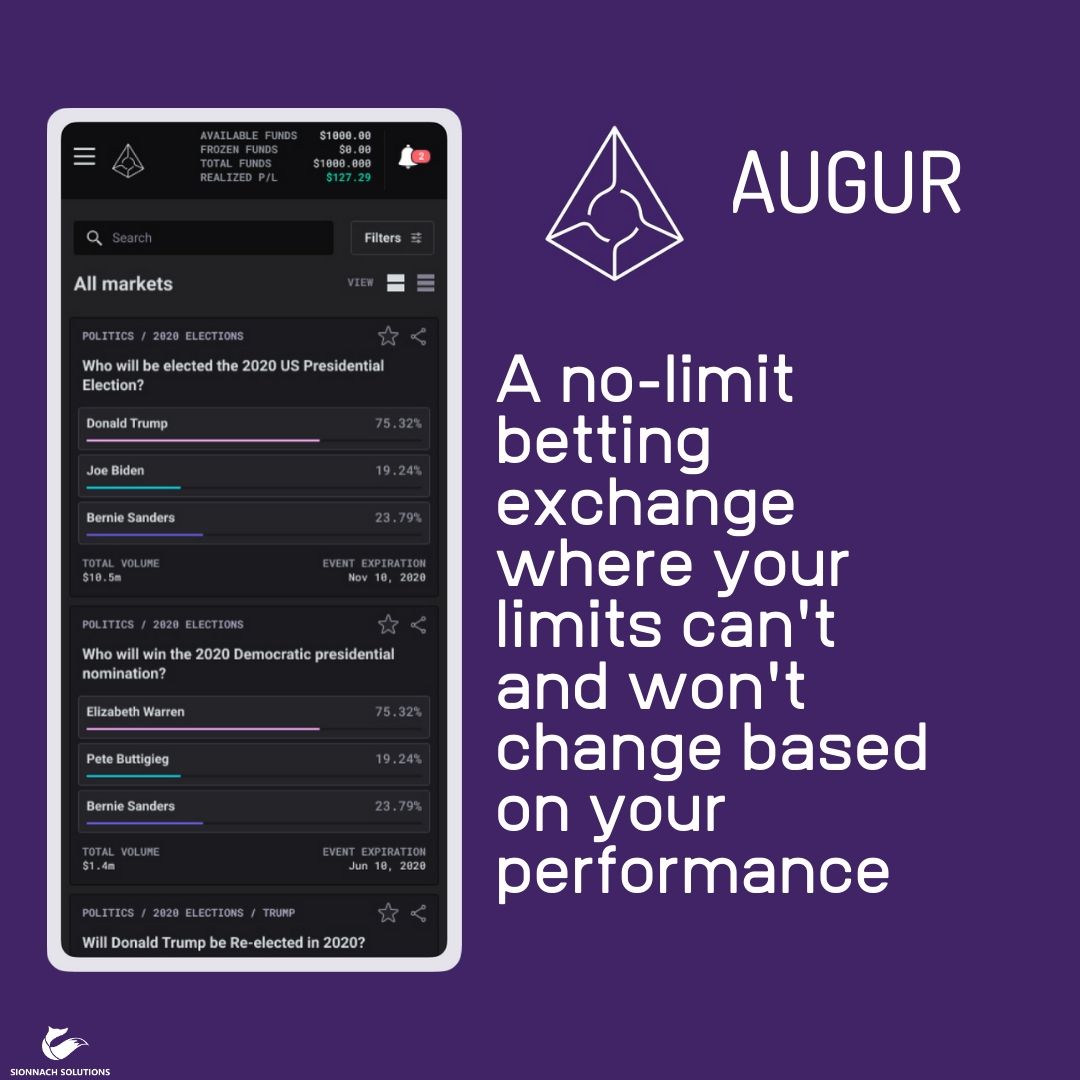

Smart Contracts

In 2015, Vitalik Buterin, a Russian-Canadian programmer launched a programmable version of a blockchain called Ethereum. Ethereum is a platform for running decentralised and autonomous applications (DApps) or organisations (DAO). Rules, known as smart contracts, set out in computer code, govern these apps or organisations. The Ethereum blockchain has its native cryptocurrency called Ether (ETH). Ethereum also facilitates the creation of crypto tokens.

Tokens

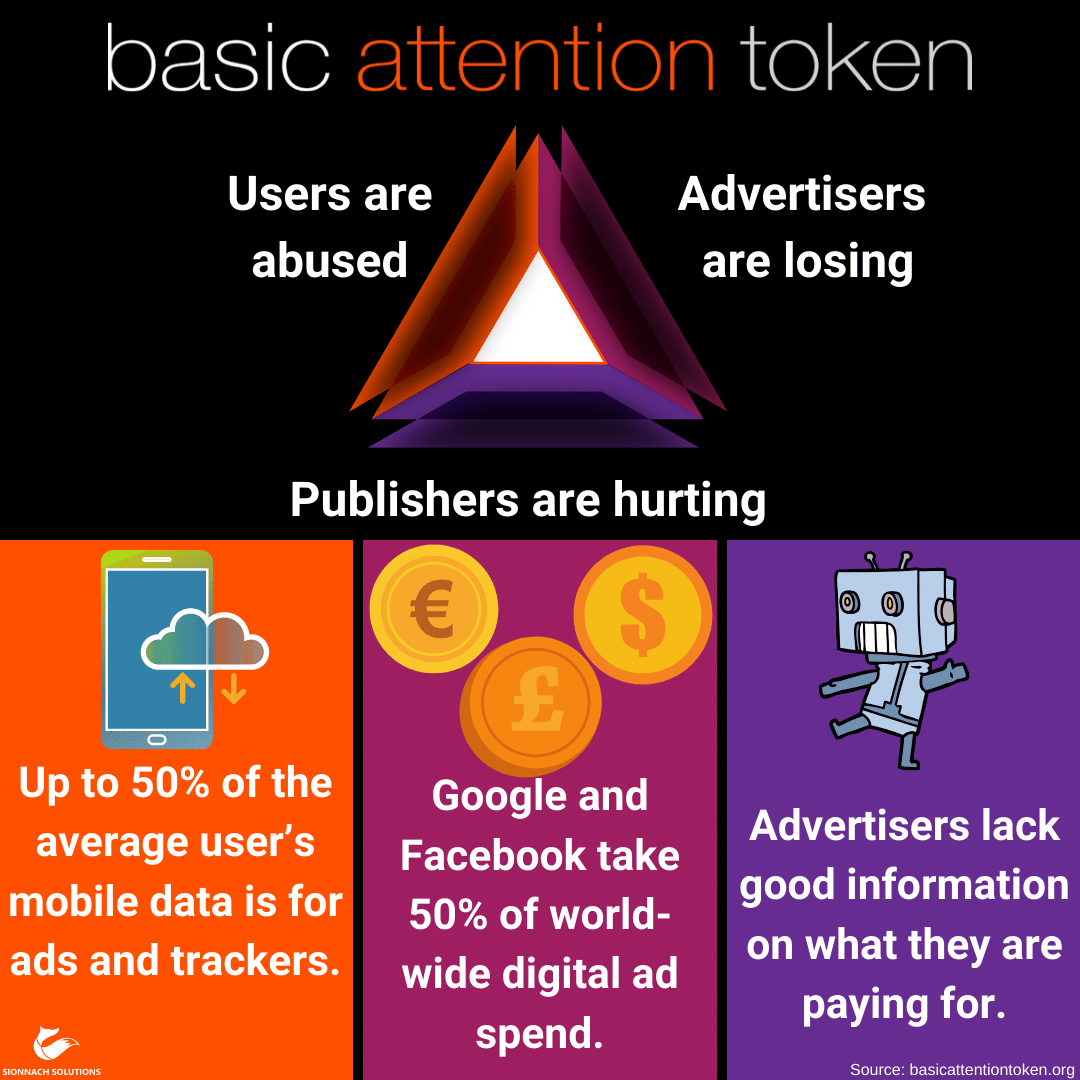

Crypto tokens are a type of cryptocurrency but often represent an asset such as points in a loyalty program or shares in an organisation. The creators of Firefox created the Basic Attention Token with aims to "radically improve the efficiency of digital advertising".

Source: basicattentiontoken.org

DApps

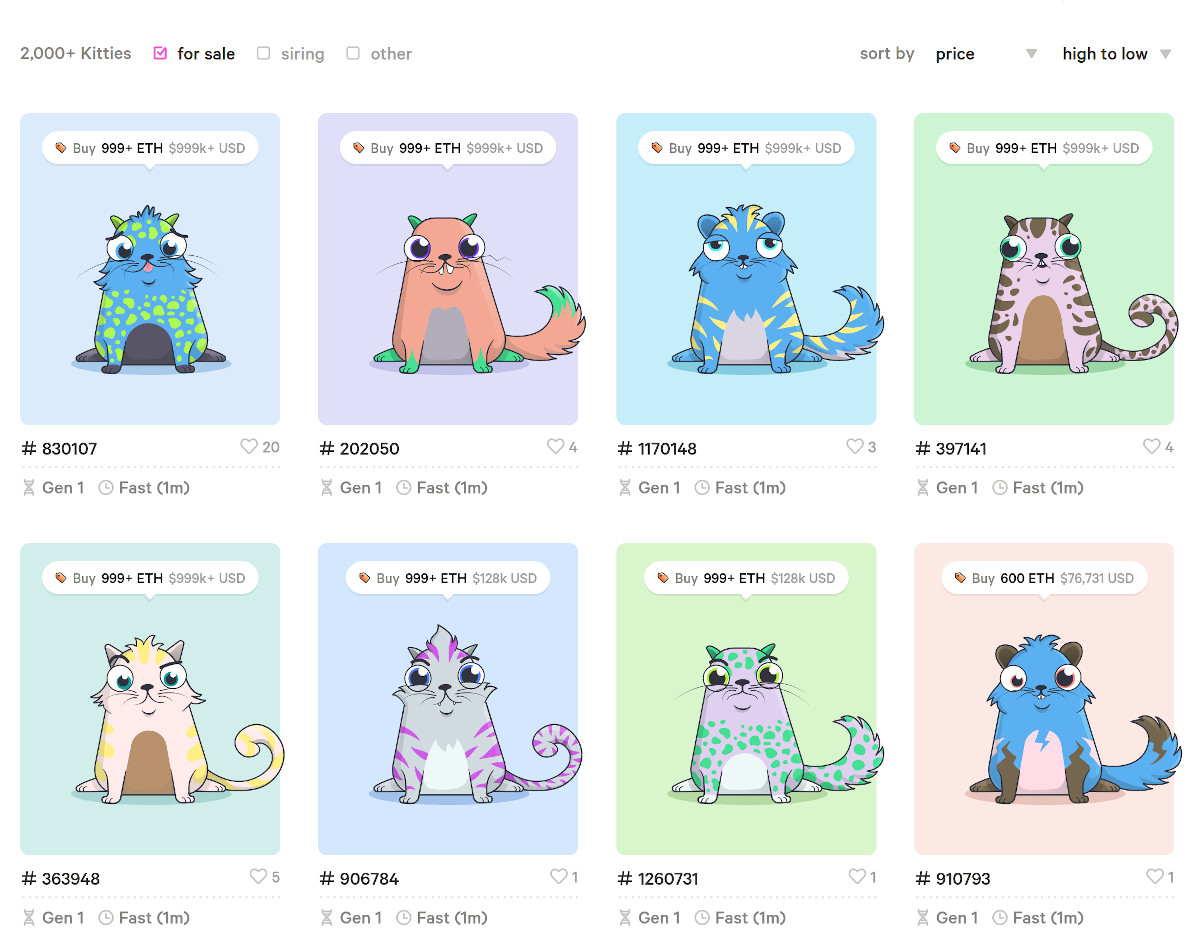

Decentralised Applications (DApps) are applications that run on a blockchain and meet particular criteria. The most important one is that it must be open-source so that anyone can look at the code and be able to verify what the code does. One of the first DApps was a Tamagotchi-like game called CryptoKitties. Within days of launch, CryptoKitties were trading at values exceeding €100,000.

NFT

This seemingly innocuous game CryptoKitties demonstrated a superbly powerful and useful feature of blockchain coupled with smart contracts, a Non-Fungible Token (NFT). A non-fungible token represents ownership of digital assets which cannot be modified. It allows the possibility for creating digital assets, such an image, an ebook, or a CryptoKitty, and assert the number of valid copies that exist and who owns them.

Nike has filed a patent application for using this method to create digital assets linked to copies of actual physical shoes sold.

DAO

A Decentralised Autonomous Organisation (DAO) is an organisation that is governed by transparent rules set in computer code rather than humans. Bitcoin eliminates the need for a central bank to issue currency or a commercial bank to validate an online transaction. Ethereum brings much more possibilities for the elimination of third-parties and human intervention in online interactions and transactions.

You may also like ...

LEO - Trading Online Voucher Scheme

Who's it for and how to get it? Everything you need to know about the 2020 Trading Online Voucher Scheme.

ReadInsane In The Domain Name

Our trials and tribulations whilst navigating the murky waters of internationalised domain names.

ReadComing next ...

Data Monetisation

How much is your data worth?

How much are companies earning from your data? Can you earn this money instead?

LocalPro

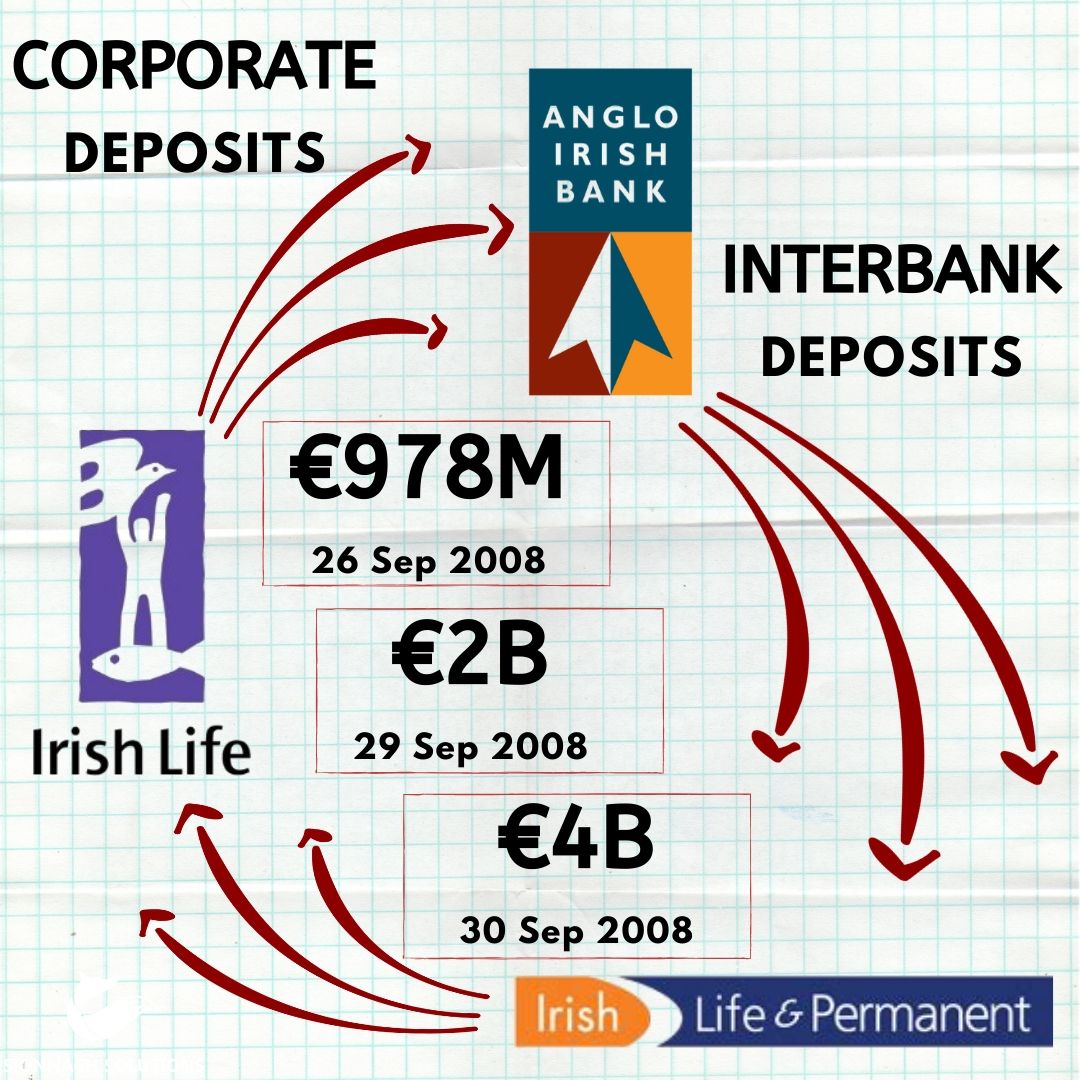

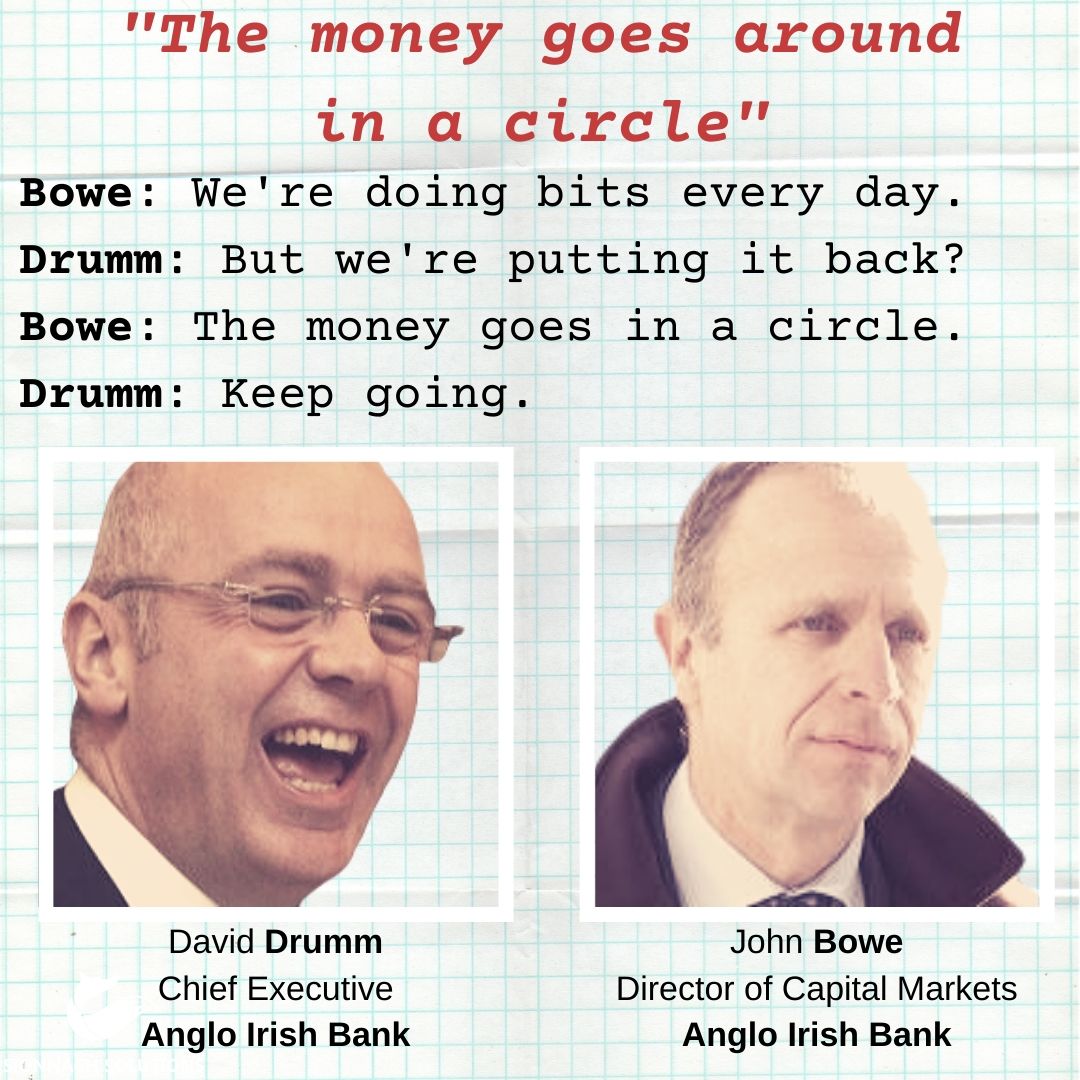

LocalPro![Bowe: The dance to get it back in time [is] becoming very tough. We pay into the bank [Irish Permanent]. The bank gives it to the assurance company [Irish Life]. The assurance company gives it back to us [Anglo Irish Bank]. An abridged transcript of a taped phone conversation between David Drumm and John Bowe on September 29th, 2008.](/images/anglo-irish-bank-circular-inter-institution-money-deposit-scam-3.jpg)